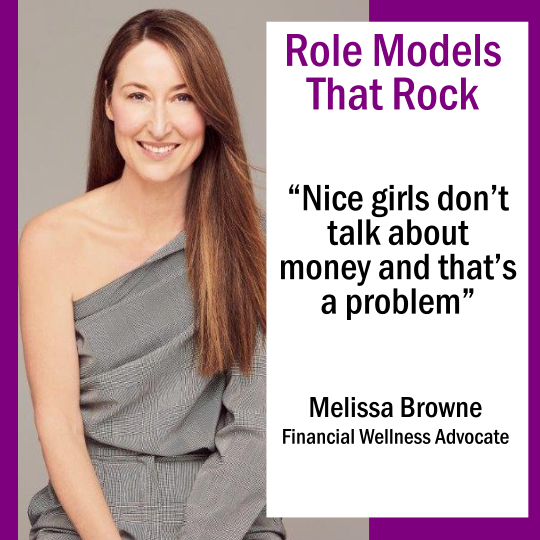

Melissa Browne

Melissa Browne

Financial Wellness Advocate

Melissa Browne is on a mission to help women manage their finances so they can buy property, get out of debt and buy shoes …

“I’m not your typical money or business chick. Yes, I’m an accountant, financial advisor and entrepreneur but I’m also a financial wellness advocate, financial coach and occasional therapist as well as an educator, speaker, advisor and multiple business owner. I’m as comfortable talking about scarcity mentality, comparison culture and shame as I am about bank accounts, shares, investing and entrepreneurship. Oh, and shoes. I can talk shoes for days!

The problem is that for women particularly, there’s an almighty ick factor when it comes to money and finances. Nice girls don’t talk about it and they certainly don’t say they want more of it. The problem is, if we want to become financially empowered, to have choice, to make societal change, to raise funds for great causes, to reduce the wage gap and look after ourselves in our old age – we kind of need to start financially adulting.”

We asked some questions of our own to find out how she got to where she is and what makes her tick.

How do you earn a living so that you can buy your beloved shoes (haha)?

Well, I own a few different businesses but in my main business, I work with women to teach them about money, investing and business. I want to help people reduce their financial overwhelm, to understand why they behave the way they do with their finances and to help them design a life they’re excited about.

My passion is to help women particularly move from where they are now to a place they didn’t even believe was possible. To become financially empowered and financially well in both their finances and in their business. To have courageous conversations – whether that’s about finances, money, business, or one of the many other things we’re avoiding in life.

What are some of the things you do every day?

Lots of things! Everything from running workshops, running courses, social media, speaking, individual strategy sessions, writing and more.

What do you love about your work?

I love that I can change someone’s lives for the better by helping them with their finances and their business. For example I’ve helped girls in their twenties buy their own home, I’ve helped women have the confidence to invest in shares and I’ve helped women get out of debt.

Did you know what you wanted to do when you were at school?

Absolutely not – and I changed my mind once I started studying law after school. (I hated it). The business I run now wasn’t even heard of or invented when I was at school.

How did you get started?

I started by studying and then I worked for big companies and then small companies before I started my own business. I read a lot of books, went back for more study and worked out that I loved business and helping people, so that’s how I ended up doing what I do today.

What’s something you’ve learned about yourself along the way?

I work best when I’m doing what I love, when I’m not stressed and when I’m not forcing myself to be something I’m not. For too long I tried to copy how I thought I should look in the business world, but I’ve realised the more I embrace who I am, the better and more effective I am – and the more confident I am.

Who helped you get to where you are today?

Who helped you get to where you are today?

My grandparents helped shape me and give me confidence – I’m so grateful to them for that. My husband has been an incredibly supportive partner. He cooks and takes care of the shopping, so I can concentrate on my work which I love. He’s also my biggest advocate and cheerleader.

I’ve also had an incredible team member, Lauren Law and a co-founder at a preschool business that I own Rod Soper who both are cheerleaders as well as accountability partners.

What are you afraid of?

Many things. I used to have a fear of being judged and people thinking badly of me. I realised over time, that you can’t change people’s opinion of you – you can only do what is best for you and the people you want to help. Seeing the results with the women and girls I’ve helped always means I care less what others think and I’m less afraid to be brave.

What’s your advice for girls thinking about a career in finance?

I believe there needs to be more women in business and finance. We have the ability to design our own lives through running our own businesses and also being educated about investing and finance. My advice would be to take risks, to be bold, to be confident and always believe you’re enough.

What are your thoughts about the future of work in your industry?

I believe we’re in for a big shake-up. There are a lot of financial advisors walking away from the industry because it’s becoming so highly regulated. I believe there needs to be more emphasis on the power of financial education and increasing financial literacy, rather than simply selling a product.

#themoneybarre

#unf*ckyourfinances

#fabulousbutbroke

#femaleempowerment

#seewhoyoucanbe

#femalesinfinance

#howdidshegetthere

#empowergirl

#financialwellbeing

#rolemodels

#girlinspiration

#dodiversitydifferently

#sharethepower

#powerfulrolemodels

#defyingstereotypes

#seethepossibilities

#inspringevents

#empoweredgirls

#empoweringevents

#jobsforgirls

#girlscandoanything

#budgeting

#wealthcreation

#financialadulting

#financialempowerment

#budgetsdon’twork